Hedging macht Fremdwährungsrisiken beherrschbar

Die gute Nachricht: Auch für mittelständische Unternehmen ohne eigene Treasury-Abteilung ist das Risiko beherrschbar. Worum geht es konkret? Für Unternehmen des Euro-Raumes tritt ein Fremdwährungs-Risiko i.d.R. dann auf, wenn in relevantem Umfang Güter in Fremdwährungen gekauft oder verkauft werden, ohne dass hierzu eine entsprechende Gegenposition in derselben Währung und in demselben Zeitraum besteht. Eingangsrechnungen in der entsprechenden Fremdwährung können z.B. als Gegenposition dienen. Man spricht dann von einem sogenannten „natural hedging“.Wechselkursschwankungen

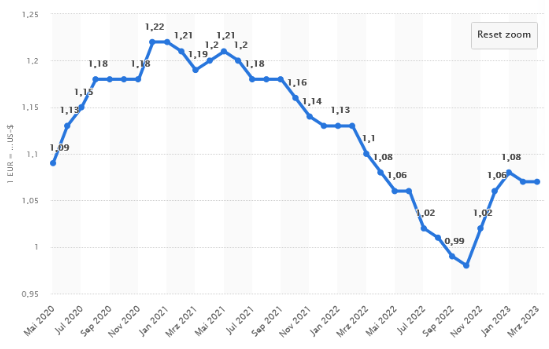

Ein weiterer entscheidender Einflussfaktor ist das Ausmaß der Wechselkursschwankung, die sogenannte Volatilität. Zum Beispiel in Zeiten von Kriegen oder Pandemien ist die Volatilität von Fremdwährungskursen besonders hoch.

Beispiel: Negativ-Effekt statt Marge

Nehmen wir an, ein deutsches Maschinenbau-unternehmen A hat im September 2022 einen Auftrag über eine Maschine im Wert von 10 Mio USD aus den USA erhalten. Der Kurs betrug zu diesem Zeitpunkt 0,98 EUR/USD. Der Auftrag wird von allen Mitarbeiter:innen ausgiebig gefeiert, da es für A ein Großauftrag ist und eine gute Marge verspricht. Die Lieferung und Faktura sollen im März 2023 erfolgen. Es besteht somit genügend Zeit, die Maschine qualitätsgerecht zu fertigen und termingerecht auszuliefern. Der amerikanische Kunde besteht wie üblich auf Faktura in USD. Obwohl Unternehmen A über keine USD-Eingangsrechnungen in demselben Zeitraum verfügen wird, entschließt sich der CFO bei Auftragserhalt im September 2022, das Geschäft nicht gegen Währungsschwankungen abzusichern. Er geht für die sechs Monate bis zur Auslieferung von einem weiter nahezu paritätischen EUR/USD-Kurs aus. Somit stellt er das Geschäft zum 30.09.2022 mit 10 Mio € in seinen Finanzplan für Q1/2023 ein. Der Einkauf beginnt unterdessen mit der Beschaffung der Teile von der Stückliste für die Maschine.Fehlende Absicherung

Das Unternehmen liefert die Maschine termingerecht am 31. März 2023 aus. Der Kurs beträgt zu diesem Zeitpunkt 1,07 EUR/USD. Unternehmen A erhält aufgrund des gestiegenen Euro zum Dollar, statt der geplanten 10 Mio € nur 9,35 Mio €. Der negative Effekt für Unternehmen A beträgt somit 650 TEUR in nur sechs Monaten. Dieser Negativ-Effekt ist voll ergebniswirksam und daher für Unternehmen A äußerst schmerzhaft. Von der zuvor geplanten guten Marge ist nichts mehr übrig. Gerade kleinere Mittelständler im Maschinenbau und der Investitionsgüterindustrie kann eine versäumte Absicherung solcher Geschäfte, insbesondere im derzeit sehr volatilen Umfeld, empfindlich treffen.Fremdwährungsrisiken im Unternehmen

Neben dem Export gibt es zahlreiche andere Ursachen, aus denen sich ein erhebliches Fremdwährungsrisiko ergeben kann, z.B. Einkauf in Fremdwährungen (z.B. in China, Indien oder den USA), oder die Bezahlung von Mitarbeiter:innen im Ausland. Auch die Rückführung von ausländischen Umsätzen oder Finanzierungen in Fremdwährungen zu einem Zeitpunkt in der Zukunft können zu erheblichen Fremdwährungsrisiken führen. Wie kann man also als Mittelständler, mit verhältnismäßig geringem finanziellem und personellem Aufwand, diesem Risiko begegnen?Grundsätzlich sollten Unternehmen, die materielle Fremdwährungsumsätze aufweisen, zunächst ein gutes Verständnis von ihrem entsprechenden Fremdwährungsrisiko entwickeln und daraus eine entsprechende Fx-hedging-Strategie erstellen. Diese besteht aus nachfolgenden Schritten:

Analyse der Fremdwährungsrisiken

- Analyse der Fremdwährungsrisiken. Hierbei stellen sie z.B. folgende Fragen:

- Wie hoch ist der Anteil Ihres Geschäfts, der zu Devisenzahlungen führt? Je höher dieser Anteil ist, desto größer ist Ihr wahrscheinliches Risiko.

- Mit welchen Ländern machen Sie Geschäfte? In einigen Ländern ist die politische Instabilität wesentlich größer und die Volatilität der Währungen ist daher wahrscheinlich höher.

- Wie häufig nehmen Sie Zahlungen vor? Je häufiger Sie Geschäfte tätigen, desto mehr werden Sie mit Wechselkursschwankungen konfrontiert sein.

- Gibt es eine einfache Prozessänderung, die das Wechselkursrisiko beseitigen oder minimieren kann, z. B. die Angleichung des Rechnungszyklus eines Kunden an die Zahlungen des Lieferanten?

- Können Sie in Ihrer Währung fakturieren und das Risiko von Wechselkursschwankungen ausschalten? Dadurch wird das Währungsrisiko auf den lokalen Kunden/Lieferanten abgewälzt.

- Haben Sie Geschäftskosten dort, wo Sie Kunden haben? Dann könnten Sie Konten in der Landeswährung nutzen, um Steuern und Lieferanten in Fremdwährung zu bezahlen und unnötige Umrechnungsgebühren zu vermeiden.

Fx-hedging-Strategie

- Festlegung der Ziele im Umgang mit Fremdwährungen

- Entwickelung, Implementierung und Umsetzung einer Fx-hedging-Policy

- Laufende Überprüfung ggfs. Anpassung der Fx-hedging-Strategie an veränderte Rahmenbedingungen (zB. Kriege oder Pandemien = erhöhte Volatilität)

- Jährliche oder quartalsweise Ergebnisüberprüfung (Kosten/Nutzen)